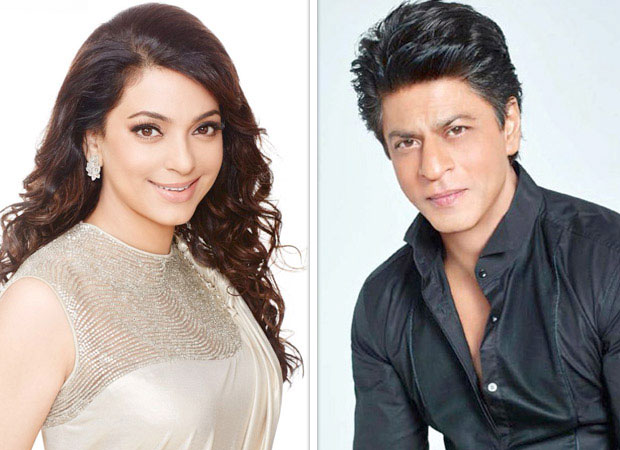

Bombay HC Stays IT notice to Shahrukh Khan and Juhi Chawla

Bombay High Court grants relief to Shah Rukh Khan, Juhi Chawla from income tax notice Granting a huge relief to actors Juhi Chawla and Shah Rukh Khan, Bombay High Court has stayed the notice issued by Income tax department against both of them. Recently, the Income tax department had sent notices to the actors for undervaluing the shares that they sold. Prior to this central investigating agency, Enforcement Directorate (ED) had sent notices to Chawla and Khan and his company Red Chillies Entertainment Pvt Ltd (RCEPL) for the same issue. As has been reported earlier Khan had formed a company Knight Riders Sports Pvt. Ltd (KRSPL) in 2008 to acquire IPL franchise rights of cricket team Kolkata Knight Riders. Initially, KRSPL was owned only by Khan’s Company Red Chillies and his wife Gauri Khan. After the success of IPL, KRSPL gave 50 lakh shares to a Mauritius-based company, The Sea Island Investment Ltd (TSIIL) owned by Chawla’s husband Jay Mehta and Chawla herself. Chawla is later said to have transferred her share of 40 lakh shares to TSIIL. All this is reported to have happened before 2010. It is alleged that all these transactions between Chawla, Khan, TSIL and RCEPL was done at the face value of each share being Rs 10. However ED alleged that the market value of all these shares was much higher and this undervaluation of shares had allegedly cost a forex loss of Rs 73.6 crore to the government of India. The Income Tax Department did nothing on the issue until the ED took up the case. The division bench of justice M S Sanklecha and Justice Riyaz Iqbal Chagla said, “The assessing officer should have applied his own mind before issuing such notices.” Chawla’s case was listed before the division bench prior to that of Khan and Red Chilli. The lawyers for others just pointed out that their case was exactly the same as Chawla’s case. The court ordered the stay of notices sent by the department against all of them. Now, the court will be hearing these petitions in the due course of time.