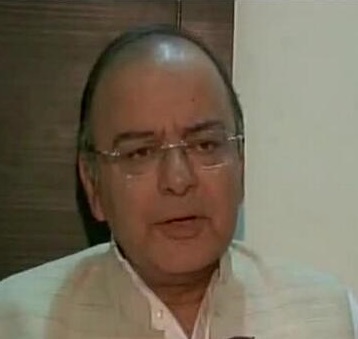

Finance Minister Arun Jaitley today promised a “reasonable compliance window” under the new black money law for persons with overseas funds to come clean, even as he asserted that targetting undeclared assets cannot be termed as ‘tax terrorism’.

Addressing industry representatives at CII annual general meeting, he also sought suggestions for improving the structure of the compliance window proposed Undisclosed Foreign Income and Assets (Imposition of Tax) Bill 2015.’

“…a very reasonable compliance window would come for those who indulged in misadventure in the past,” the Finance Minister said.

“If some reasonableness is required, the government or Parliament or the legislature will be open to reasonable suggestions which will be welcomed in these matters.”

The government had introduced the stringent Bill in the Lok Sabha to deal with the menace of black money stashed abroad. Besides other things, the law provides for imprisonment of up to ten years for hiding foreign assets.

It will also provide a short-term compliance window for people having undisclosed income abroad to come clean.

Jaitley further said that in view of the efforts being made globally by the US and organisations like G-20 to deal with black money, it would be difficult for anyone to hide foreign assets.

“Over the next 2-3 years, G-20 initiative for automatic exchange of information is going to take shape. India is going to become a signatory to the US law FATCA, and thereafter not only the US, other countries inter-se would also be discharging their obligation to each other.

“…the disconnect from the past will surely come…

rather than wait for that opportunity where people run into trouble and then say targeting undeclared, undisclosed income or assets abroad is terrorism, it would be in everybody’s interest that the rule of law is complied with,” Jaitley said.