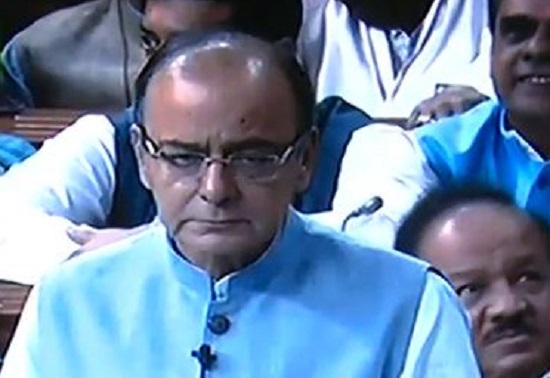

Finance Minister Arun Jaitley today listed ‘nine pillars’ including tax reforms, promoting ease of doing business and ensuring fiscal discipline, that will transform India. Unveiling the Budget 2016-17, he said the pillars also include emphasis on governance reforms. The other pillars, he added, include focus on agriculture and rural areas with a view to doubling farm income by 2022.

Besides, he said, government will lay greater emphasis on social sectors, education and skill building and job creation for building a knowledge based and productive economy. The government, Jaitley said, will also focus on infrastructure investment, financial sector reforms, fiscal discipline and tax reforms to reduce compliance burden.

Revenue deficit target improved from 2.8 pc to 2.5 pc in current fiscal

Govt plans to spend Rs 19.78 lakh crore in 2016-17 – Rs 5.5 lakh crore under plan head, Rs 14.28 lakh crore under non-plan head

Stock market loss widens; Sensex crashes over 600 points and Nifty down over 200 points on Budget taxation proposals

Service tax on single premium annuity to be reduced to 1.5 per cent from 3.5 per cent

DBT to be used to transfer subsidy on fertilizer in select districts on pilot basis

Rs 900 cr provided to buffer fund created to moderate prices of pulses

1st home buyers to get additional deduction of Rs 50,000 on interest for loan upto Rs 35 lakh. Cost of house should not be more than Rs 50 lakh

Govt to introduce bill to amend Companies Act for ease of doing business; to enable registration of cos

Service Tax to be exempted on general insurance schemes under NIRMAYA Scheme

Target delivery of financial, other intermediary services will be introduced using Aadhar in this Budget session

Sensex plunges nearly 300 points, Nifty over 100 points as Finance Minister presents taxation proposals in Budget 2016-17

In 2016-17, govt eyes Rs 1,80,000 crore credit target through Mudra bank

Govt to increase ATMs, micro-ATMs in post offices in next three years

Accelerated depreciation to be limited to 40 % wef from Apr 1, 2017 as part of phasing out of exemptions to industry

Consolidation roadmap for public sector banks to be spelt next year; govt open to reducing its stake in PSBs below 50 %

Presemtive income tax scheme to be extended to all professionals with income of Rs 50 lakh with a presumption of 50 % profit

Deduction for rent paid will be raised from Rs 20,000 to Rs 60,000 to benefit those living in rented houses

SEBI Act to be amended to provide for more benches for Securities Appellate Tribunal

Rs 25,000 cr to be provided for recapitalisation of public sector banks

Relief will amount to Rs 3000 per annum; 1 cr tax payers to benefit

Ceiling of tax rebate for tax payers with up to Rs 5 lakh annual come to be raised to Rs 5000 from Rs 2000 currently

SEBI to develop new derivatives products as well as products for corporate bond market

RBI Act to be amended to provide statutory backing for monetary policy framework and monetary policy committee (MPC)

A comprehensive bankruptcy code to be enacted as part of financial sector reforms

Department of Disinvestment to be remained Department of Investment and Public Asset Management

Govt to allow 100 per cent FDI through FIPB in marketing of food products produced and manufactured in India

Govt to bring new policy for strategic sale of CPSE assets

More FDI reforms proposed in insurance, pension, asset restructuring companies and stock markets

A new credit rating system for infrastructure will be developed

Govt considering to provide calibrated market freedom to new gas production from deep sea, ultra deep sea to boost stagnant domestic output

Govt preparing a comprehensive plan for nuclear power generation and allocation could be up to Rs 3,000 crore per annum

A Public Utility Resolution of Disputes Bill to be passed to solve problems in infrastructure contracts, PPP and public utilities

Rs 8000 cr provided for Sagarmala project

Total allocation for road and rail in 2016-17 is Rs 2.18 lakh crore

160 airports and airstrips can be revived at a cost of Rs 50-100 crore each

2,000 kilometres of state highways to be converted into national highways

Abolition of permit law will be our medium-term goal in public transport

Proposed to allocated Rs 55,000 crore for roads and highways; total investment in road sector would be Rs 97,000 core

Total outlay for infrastrucutre at Rs 2.21 lakh crore for 2016-17

Rs 97,000 cr allocation for road sector including rural roads

Shopping malls to be allowed to open on all seven days of week; a model shops and establishment bill to be circulated to states

85 % of stuck road projects have been put back on track; highest ever contracts awarded in current fiscal

Govt to pay 8.33 pc towards employee pension fund

1500 multi-skill training institutes to be opened to train youths under Skill Development programme; Rs 1.7K crore earmarked

Govt to spend Rs 1,700 crore to set up 1,500 multi-skill training institutes

One cr youth to be skilled over next three years

Govt to create digital depository for school leaving certificates

62 new Navodaya vidyalayas to be opened in next two years

Certain parts of dylasis machines to be exempt from all forms of customs duty;national dylasis service programme to be launched in all dist

Govt to provide Rs 500 crore for Stand Up India scheme

A new health protection scheme to provide cover up to Rs one lakh per family; top up of Rs 35,000 for people above 60 yrs